Brain-booster /

10 Aug 2023

Brain Booster for UPSC & State PCS Examination (Topic: Unified Payments Interface - UPI)

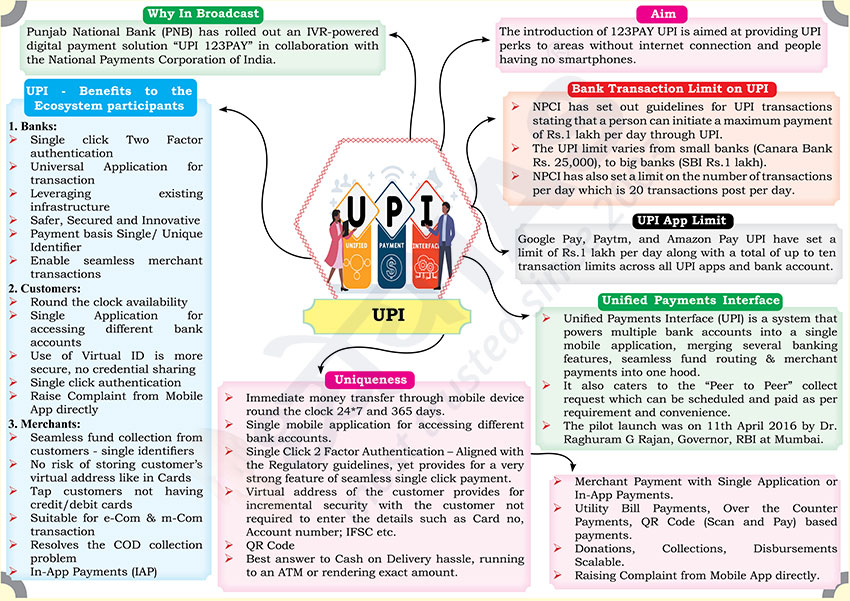

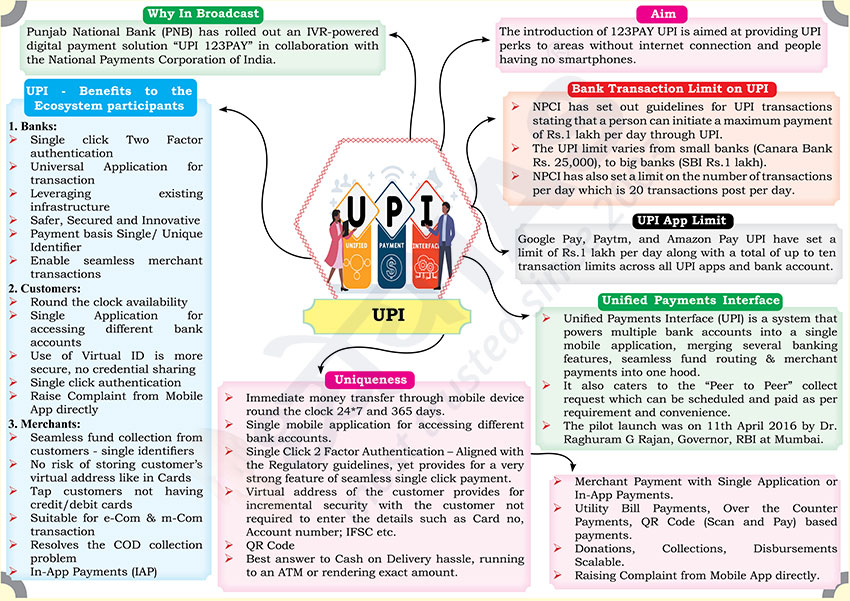

Why in Broadcast?

- Punjab National Bank (PNB) has rolled out an IVR-powered digital payment

solution “UPI 123PAY” in collaboration with the National Payments

Corporation of India.

Aim

- The introduction of 123PAY UPI is aimed at providing UPI perks to areas

without internet connection and people having no smartphones.

Bank Transaction Limit on UPI

- NPCI has set out guidelines for UPI transactions stating that a person

can initiate a maximum payment of Rs.1 lakh per day through UPI.

- The UPI limit varies from small banks (Canara Bank Rs. 25,000), to big

banks (SBI Rs.1 lakh).

- NPCI has also set a limit on the number of transactions per day which is

20 transactions post per day.

UPI App Limit

- Google Pay, Paytm, and Amazon Pay UPI have set a limit of Rs.1 lakh per

day along with a total of up to ten transaction limits across all UPI apps

and bank account.

Unified Payments Interface

- Unified Payments Interface (UPI) is a system that powers multiple bank

accounts into a single mobile application, merging several banking features,

seamless fund routing & merchant payments into one hood.

- It also caters to the “Peer to Peer” collect request which can be

scheduled and paid as per requirement and convenience.

- The pilot launch was on 11th April 2016 by Dr. Raghuram G Rajan,

Governor, RBI at Mumbai.

Uniqueness

- Immediate money transfer through mobile device round the clock 24*7 and

365 days.

- Single mobile application for accessing different bank accounts.

- Single Click 2 Factor Authentication – Aligned with the Regulatory

guidelines, yet provides for a very strong feature of seamless single click

payment.

- Virtual address of the customer provides for incremental security with

the customer not required to enter the details such as Card no, Account

number; IFSC etc.

- QR Code

- Best answer to Cash on Delivery hassle, running to an ATM or rendering

exact amount.

UPI - Benefits to the Ecosystem participants

1. Banks:

- Single click Two Factor authentication

- Universal Application for transaction

- Leveraging existing infrastructure

- Safer, Secured and Innovative

- Payment basis Single/ Unique Identifier

- Enable seamless merchant transactions

2. Customers:

- Round the clock availability

- Single Application for accessing different bank accounts

- Use of Virtual ID is more secure, no credential sharing

- Single click authentication

- Raise Complaint from Mobile App directly

3. Merchants:

- Seamless fund collection from customers - single identifiers

- No risk of storing customer’s virtual address like in Cards

- Tap customers not having credit/debit cards

- Suitable for e-Com & m-Com transaction

- Resolves the COD collection problem

- In-App Payments (IAP)