Brain-booster /

30 Nov 2021

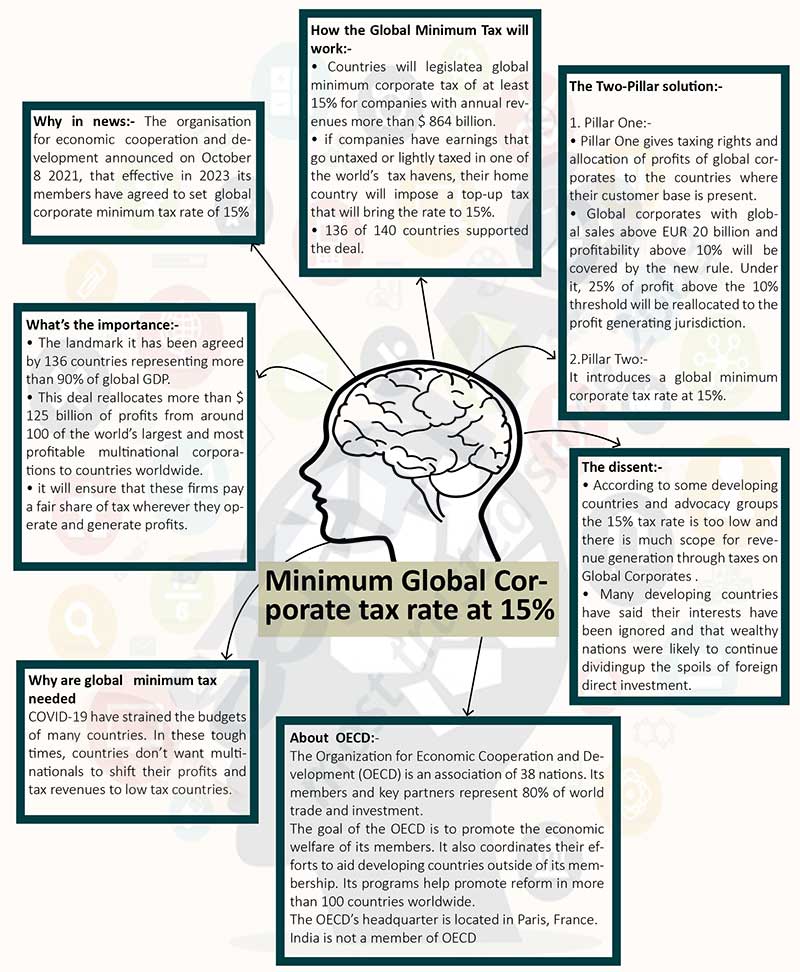

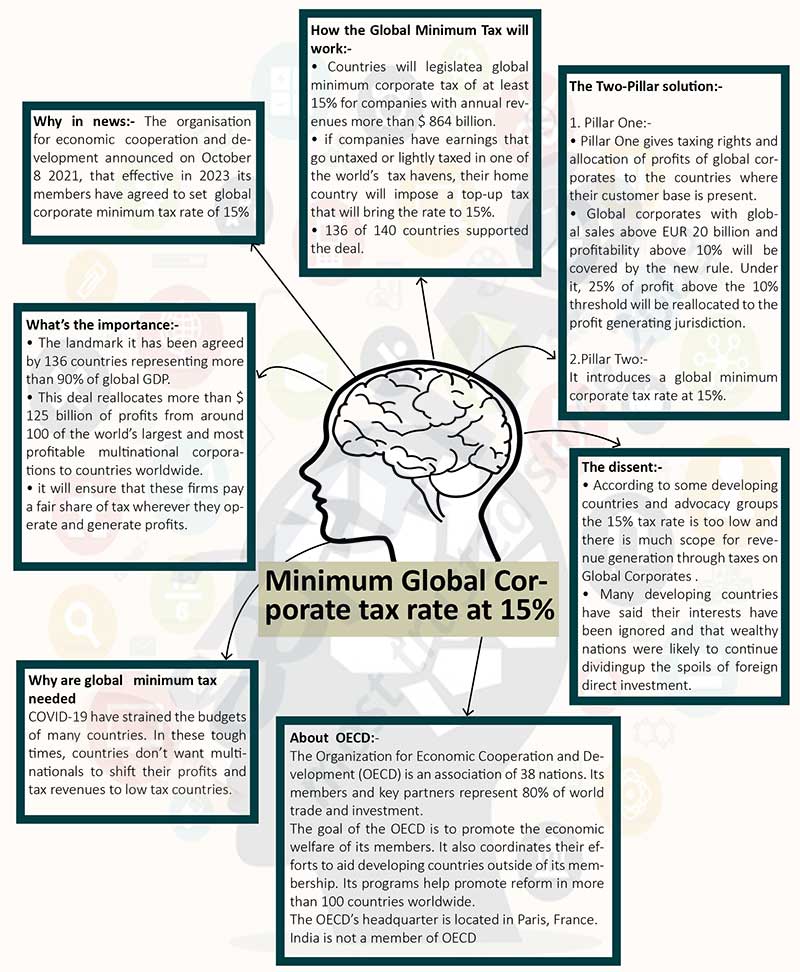

Brain Booster for UPSC & State PCS Examination (Topic: Minimum Global Corporate tax rate at 15%)

Why in news:-

- The organisation for economic cooperation and development announced on

October 8 2021, that effective in 2023 its members have agreed to set global

corporate minimum tax rate of 15%

What’s the importance:-

- The landmark it has been agreed by 136 countries representing more than

90% of global GDP.

- This deal reallocates more than $ 125 billion of profits from around 100

of the world’s largest and most profitable multinational corporations to

countries worldwide.

- it will ensure that these firms pay a fair share of tax wherever they

operate and generate profits.

Why are global minimum tax needed

- COVID-19 have strained the budgets of many countries. In these tough

times, countries don’t want multinationals to shift their profits and tax

revenues to low tax countries.

How the Global Minimum Tax will work:-

- Countries will legislatea global minimum corporate tax of at least 15%

for companies with annual revenues more than $ 864 billion.

- if companies have earnings that go untaxed or lightly taxed in one of

the world’s tax havens, their home country will impose a top-up tax that

will bring the rate to 15%.

- 136 of 140 countries supported the deal.

About OECD:-

- The Organization for Economic Cooperation and Development (OECD) is an

association of 38 nations. Its members and key partners represent 80% of

world trade and investment.

- The goal of the OECD is to promote the economic welfare of its members.

It also coordinates their efforts to aid developing countries outside of its

membership.

- Its programs help promote reform in more than 100 countries worldwide.

- The OECD’s headquarter is located in Paris, France.

- India is not a member of OECD.

The Two-Pillar solution:-

1. Pillar One:-

- Pillar One gives taxing rights and allocation of profits of global

corporates to the countries where their customer base is present.

- Global corporates with global sales above EUR 20 billion and

profitability above 10% will be covered by the new rule. Under it, 25% of

profit above the 10% threshold will be reallocated to the profit generating

jurisdiction.

2. Pillar Two:-

- It introduces a global minimum corporate tax rate at 15%.

The dissent:-

- According to some developing countries and advocacy groups the 15% tax

rate is too low and there is much scope for revenue generation through taxes

on Global Corporates .

- Many developing countries have said their interests have been ignored

and that wealthy nations were likely to continue dividingup the spoils of

foreign direct investment.